A nonprofit organization is a corporation, LLC, unincorporated association, or other legal structure formed for not-for-profit purposes. Its not-for-profit purpose is declared when the legal structure is formed. Obtainment of 501(c)(3) or other tax exemption does NOT define whether the organization is a nonprofit.

A nonprofit organization is an organization that serves the public interest. In general, the purpose of this type of organization must be charitable, educational, scientific, religious or literary. The public expects to be able to make donations to these organizations and deduct these donations from their federal taxes.

A nonprofit organization is exempt from paying federal corporate income tax. While these types of organizations also are often exempt from paying state and local sales tax, property tax and taxes on other assets, this is not always the case as states have different rules.

A nonprofit organization has paid and volunteer staff, but employment taxes and federal and state workplace rules are generally no different than those imposed on for-profit organizations. *A poor practice is pay low salaries. Nonprofit organizations can make a huge difference in how closely it compares to a for-profit business.

A nonprofit organization can have clients, can offer products and services, will need revenue, should market itself, and must be concerned about customer satisfaction whether in those assisted or those who contribute donations in support of operations, programs or services. It is a business that must serve the public interest and it will succeed or fail as any business will, depending on how well it is operated.

The difference between nonprofit and for-profit organizations is that nonprofits do not declare a profit and instead utilizes all revenue available after normal operating expenses in service to the public interest while for-profits distribute their profits to their owners or stockholders.

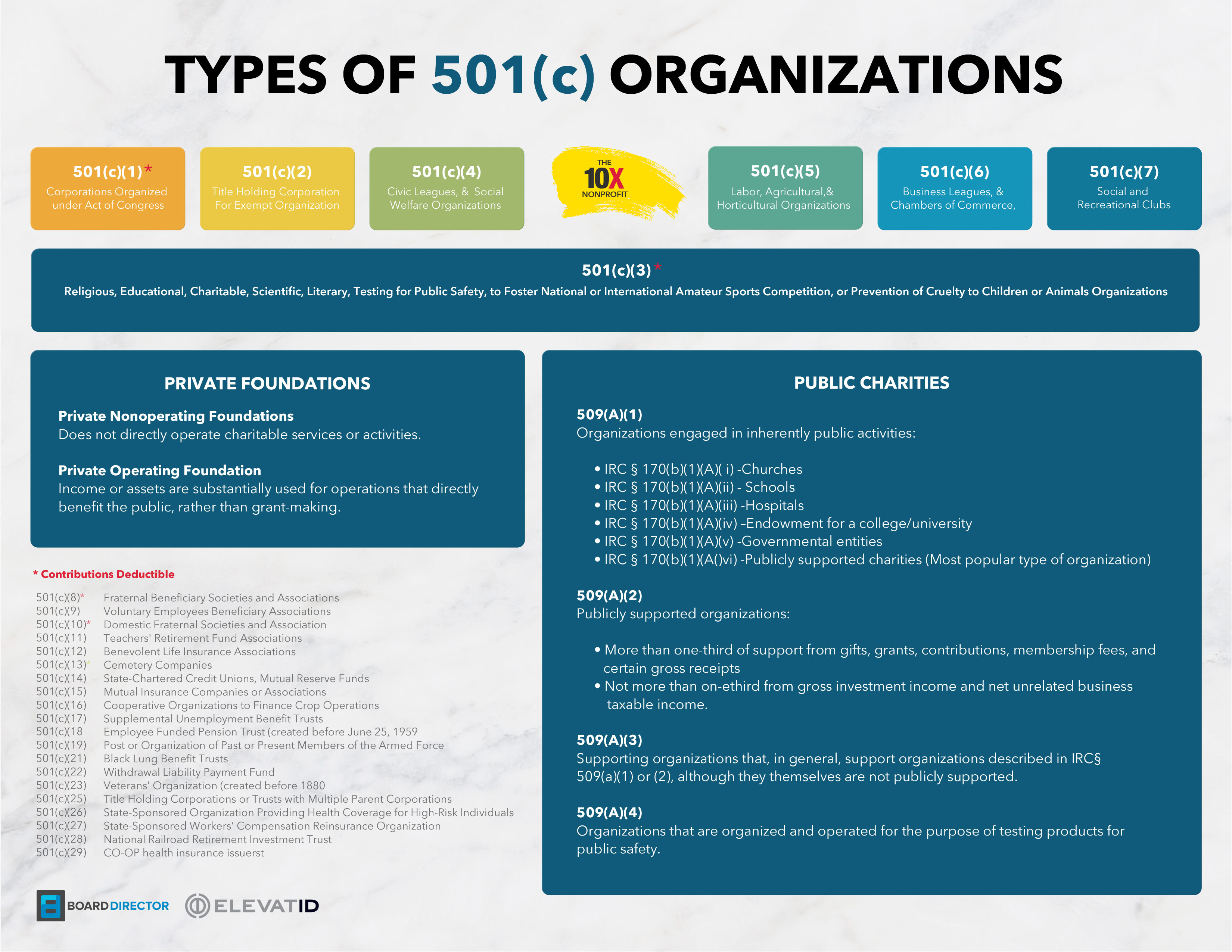

Nonprofit organizations fall into 7 main categories:

- 501(c)(3) Charitable Religious, and Educational Organizations

- 501(c)(4) Civic leagues and social welfare organizations

- 501(c)(5) Labor/agricultural/horticultural organizations

- 501(c)(6) Business and professional leagues

- 501(c)(7) Social and recreational clubs

- 501(c)(8) Fraternal beneficiary societies

- 501(c)(9) Veterans organizations

A “public charity” must meet a 509(a) exception.

509(a)(1)

The criteria for being a 509(a)(1) public charity simply refers to organizations engage in inherently public activities described in Section 170(b)(1)(A)(i)-(vi):

- IRC § 170(b)(1)(A)( i) – Churches

- IRC § 170(b)(1)(A)(ii) – Schools

- IRC § 170(b)(1)(A)(iii) – Hospitals

- IRC § 170(b)(1)(A)(iv) – Endowment for a college/university

- IRC § 170(b)(1)(A)(v) – Governmental entities

- IRC § 170(b)(1)(A()vi) – Publicly supported charities

509(a)(2)

Publicly supported organizations:

- More than one-third of support from gifts, grants, contributions, membership fees, and certain gross receipts

- Not more than one-third from gross investment income and net unrelated business taxable income

509(a)(3)

Supporting organizations that, in general, support organizations described in IRC § 509(a)(1) or (2), although they themselves are not publicly supported.

509(a)(4)

Organizations that are organized and operated for the purpose of testing products for public safety.